8594483006: Maximizing Profits in a Volatile Market

Maximizing profits in a volatile market requires a calculated approach. Investors must understand the nuances of market fluctuations and their implications on various asset classes. A diversified portfolio can serve as a buffer against unpredictability. Moreover, innovative trading techniques, such as algorithmic strategies, offer enhanced execution capabilities. However, the key lies in continuously adapting to changing market conditions. What strategies can truly optimize returns while minimizing exposure to risks?

Understanding Market Volatility and Its Impact on Investments

How does market volatility influence investment strategies?

Market fluctuations create an environment where investors must carefully assess investment risks.

Strategic decision-making becomes essential, as volatility can amplify both potential gains and losses.

Investors seeking financial freedom must adapt their strategies to navigate these unpredictable conditions, ensuring they remain resilient against market shifts while optimizing their portfolios for long-term success amid inherent uncertainties.

Strategies for Diversifying Your Portfolio

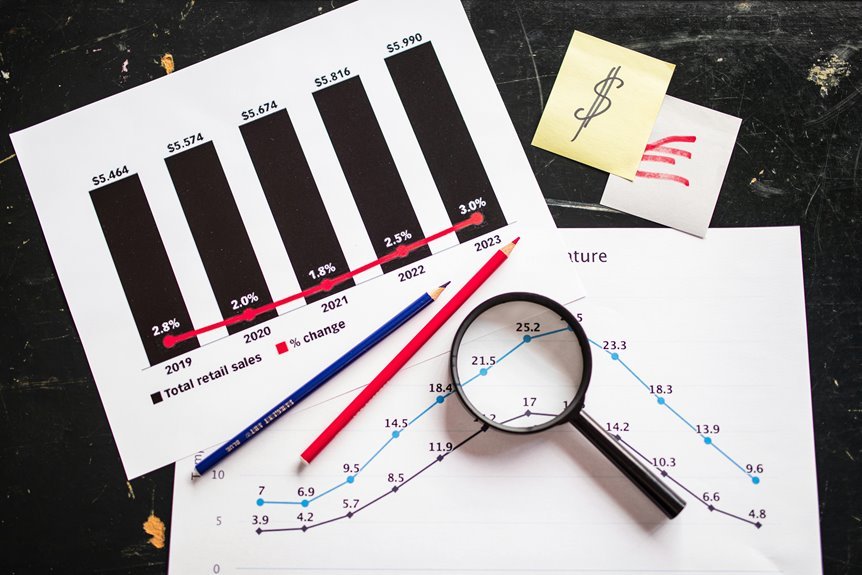

A well-diversified portfolio is essential for mitigating risks associated with market volatility.

Effective asset allocation across various asset classes, including equities, bonds, and alternative investments, enhances risk management.

By balancing investments, individuals can protect against market downturns while capitalizing on growth opportunities.

This strategic approach not only fosters financial freedom but also positions investors to navigate uncertainties with greater resilience.

Innovative Trading Techniques for Profit Maximization

Numerous innovative trading techniques have emerged as effective strategies for profit maximization in today's volatile market landscape.

Algorithmic trading has gained prominence, leveraging advanced algorithms to execute trades swiftly and accurately.

Coupled with robust risk management practices, these techniques empower traders to navigate market fluctuations, optimizing returns while mitigating potential losses.

This strategic approach fosters a sense of freedom, enabling traders to capitalize on opportunities with confidence.

Conclusion

In conclusion, navigating a volatile market necessitates a strategic, diversified approach to investment. Notably, studies indicate that a well-diversified portfolio can reduce overall risk by up to 30%, underscoring the importance of asset allocation. By employing innovative trading techniques and continuously monitoring market conditions, investors can not only safeguard their capital but also seize lucrative opportunities. Ultimately, a proactive strategy in an unpredictable environment can lead to substantial profit maximization over time.